NZD/USD: Also sometimes trading along with commodity prices, the New Zealand Dollar versus the U.S.Dollar versus the Canadian Dollar exchange rate tends to be sensitive to the price of oil since Canada exports oil and the U.S. USD/CAD: Another commodity-linked currency, the U.S.Australia’s economy is the 13 th largest in the world and its chief trading partner is China, which buys the bulk of Australian exports.

Nicknamed the Aussie, It trades closely with the commodities market because Australia’s economy is primarily based on the export of natural resources.

Foreign currency compare the market iso#

The reason the currency goes by the ISO 4217 symbol CHF is that it derives from the old Latin name of Switzerland: Confederacion Helvetia Franc.

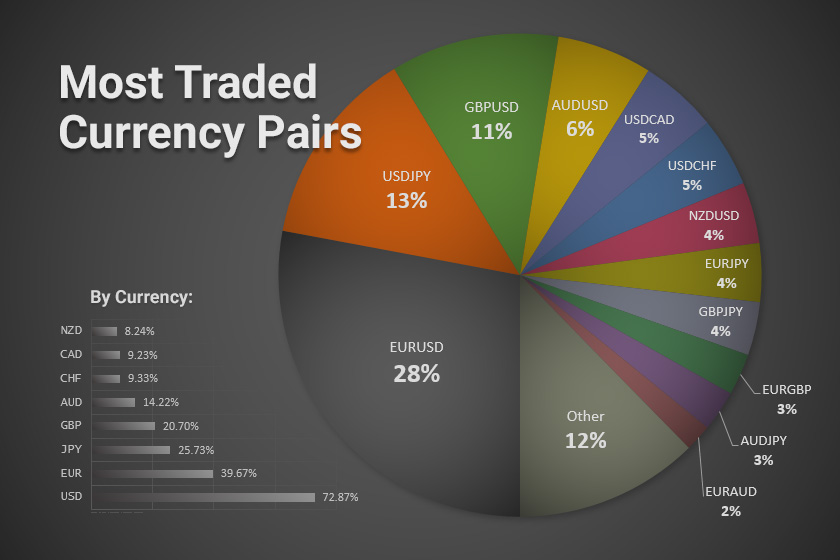

coming in number six in economic size by GDP. Dollar rate has been nicknamed Cable since the late 1800s and is the third most actively traded currency pair with 13% of total daily forex volume and the U.K. The United States and the European Union are Japan’s largest trading partners. While being a small country, the Japanese economy is the third largest in the world by GDP. USD/JPY: The Dollar Yen rate accounts for over 13% of total daily forex volume and is the second most actively traded currency pair.The Eurozone countries that consolidated their national currencies into the Euro together make up the largest economy in the world by GDP, with the United States in second place. EUR/USD: EUR/USD makes up the overall volume leader in the foreign exchange market, and this currency pair accounts for over 27% of overall daily forex trading volume according to the Bank for International Settlements or BIS.These details should be researched thoroughly before attempting to trade a currency pair.Ī brief description of each of the major currency pairs follows: Open a Forex demo account Specific Major Currency Pairs DescribedĮach currency pair has its own characteristics and behaves as a unique trading instrument. Dollar acts as the counter currency such as EUR/USD, GBP/USD, AUD/USD and NZD/USD use the country’s home currency as the pricing currency, and so quotations in these pairs are sometimes referred to as indirect rates. These quotations are sometimes referred to as direct rates since the country’s home currency is used as the pricing currency.įurthermore, currency pairs where the U.S. Dollar as the base currency, such as USD/JPY, USD/CAD and USD/CHF. Some major currency pairs and just about all minor currency pairs are quoted with the U.S. The Dollar continues being important, with over 86% of all forex trades still involving the currency. Dollar has historically been the most traded currency in its role as the world’s primary reserve currency. Dollar: NZD/USDĪs mentioned above, the U.S. Dollar versus the Canadian Dollar: USD/CAD These include the following pairs ordered by trading volume: The seven most actively traded currency pairs currently trading in the foreign exchange market, also known as the Majors all trade against the U.S. Major Currency Pairs All Quoted Against The U.S. Switzerland also eventually stopped the convertibility to gold of the Swiss Franc in 2000. President Richard Nixon unilaterally stopped the Dollar’s convertibility to gold, virtually all nations with the exception of Switzerland went off this de facto gold standard.

Dollar, which at that time was still on the gold standard, and fixed the price of gold at $35 per ounce.Īfter 1971, when U.S. When implemented post war, this Bretton Woods system of fixed exchange rates pegged major world currencies to the U.S. Dollar to be chosen as the world’s reserve currency at the Bretton Woods conference held in New Hampshire in 1944, just before the end of the war. Despite proposals for the creation of a neutral global reserve currency called the bancor, pressures prevailed for the U.S.

0 kommentar(er)

0 kommentar(er)